The Challenge and the Opportunity

Picture this: You’ve developed the perfect financial SaaS tool that integrates seamlessly with QuickBooks and Xero, but your brilliant product is sitting in digital obscurity because you can’t reach the small business owners and finance professionals who need it most.

This scenario plays out daily across the B2B marketing landscape, where countless companies struggle to connect with accounting software users despite having solutions that could genuinely transform their workflows.

The frustration is understandable. Traditional marketing channels often cast too wide a net, burning through budgets while missing the mark on qualified leads. Cold calling feels intrusive and yields diminishing returns.

Social media advertising can be hit-or-miss when targeting such specific software users. Meanwhile, your competitors who’ve cracked the code on reaching QuickBooks and Xero audiences are quietly building robust pipelines.

Here’s the opportunity that many marketers overlook: QuickBooks and Xero collectively serve millions of small and medium-sized businesses worldwide, creating one of the most concentrated pools of high-intent prospects in the B2B space.

These aren’t casual browsers or tire-kickers—they’re businesses already invested in digital financial management, actively seeking ways to streamline operations and improve their bottom line.

The key lies in approaching this audience with ethical, compliant, and genuinely effective methods that respect their time while delivering real value. This article will show you exactly how to do that, providing a roadmap that balances aggressive growth with responsible marketing practices.

Why Targeting QuickBooks and Xero Users Matters for B2B Marketing

The Size of the Opportunity

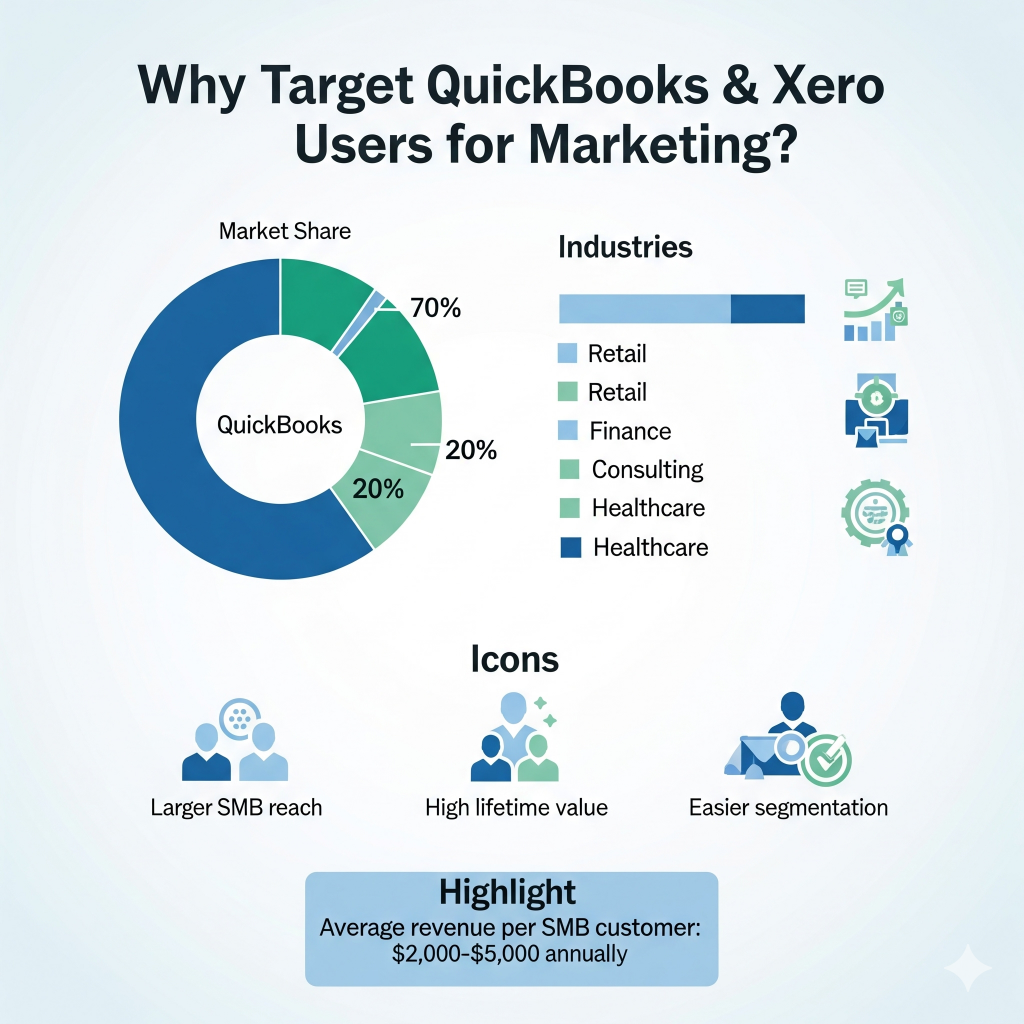

The numbers tell a compelling story. QuickBooks dominates the small business accounting software market with over 7 million subscribers globally, while Xero serves more than 3.95 million subscribers across 180+ countries.

Combined, these platforms represent a massive ecosystem of businesses actively managing their finances through cloud-based solutions—exactly the kind of digitally-savvy prospects most B2B companies want to reach.

What makes these numbers even more impressive is the growth trajectory. The global accounting software market is projected to reach $20.5 billion by 2026, with small and medium enterprises driving much of this expansion.

These businesses aren’t just adopting accounting software; they’re building entire tech stacks around these platforms, creating multiple touchpoints for complementary solutions.

High Intent Audience

Unlike generic business lists where decision-making authority can be unclear, QuickBooks and Xero users typically fall into well-defined categories: business owners, CFOs, controllers, bookkeepers, and accountants.

These individuals don’t just influence purchasing decisions—they often make them directly, especially in smaller organizations where financial software choices rest with whoever manages the books.

Consider the mindset of someone actively using QuickBooks or Xero. They’ve already recognized the value of investing in financial management tools, moved beyond basic spreadsheets, and demonstrated willingness to pay for software that improves their operations.

This behavioral profile suggests they’re open to additional solutions that integrate well with their existing workflows.

Use Cases for Outreach

The applications for reaching QuickBooks user leads and building a targeted Xero email list extend far beyond what many marketers initially consider.

Yes, the obvious candidates include payment processing solutions, expense management tools, and inventory management systems that integrate directly with these platforms.

But the opportunities go deeper. Professional services firms offering bookkeeping, tax preparation, or business consulting can target users who might need additional expertise.

Fintech companies developing lending products can reach businesses already demonstrating financial responsibility through proper accounting practices. HR and payroll solutions can target the same decision-makers who chose their accounting software.

Even companies in adjacent industries find value in targeting accounting software leads. Insurance providers targeting small businesses, legal firms specializing in business formation, and marketing agencies serving professional services all benefit from reaching an audience of established, financially-conscious business owners.

The key is understanding that QuickBooks and Xero users represent more than just accounting software adoption—they signal business maturity, digital readiness, and decision-making authority that makes them valuable prospects across numerous categories.

Ethical and Compliant Ways to Source Email Addresses

Understanding Regulations

Before diving into tactics, let’s address the regulatory landscape that governs how you can collect and use email addresses for marketing purposes. The rules aren’t suggestions—they’re legal requirements that can result in significant penalties for violations.

The General Data Protection Regulation (GDPR) applies to any marketing targeting individuals in the European Union, regardless of where your company is located. Under GDPR, you need explicit consent to collect and use personal data for marketing purposes, and recipients must have an easy way to withdraw that consent at any time.

The CAN-SPAM Act governs email marketing in the United States, requiring clear sender identification, truthful subject lines, and easy unsubscribe mechanisms.

The California Consumer Privacy Act (CCPA) adds another layer of requirements for businesses dealing with California residents.

These regulations aren’t obstacles to navigate around—they’re frameworks for building trust with your audience.

Companies that embrace compliance from the start often see better engagement rates because their recipients know they can trust the sender to respect their preferences.

What’s Allowed vs. Risky

The temptation to take shortcuts in lead generation is real, especially when you see competitors seemingly thriving with questionable practices. However, the distinction between legitimate and risky approaches is crucial for long-term success.

Legitimate approaches include partnering with vetted data providers who can demonstrate compliance with privacy regulations, building your own lists through opt-in mechanisms, and using publicly available information in ways that respect privacy expectations.

These methods may require more upfront investment and patience, but they create sustainable, high-quality prospect lists.

Risky practices include purchasing email lists from unknown sources, scraping contact information without consent, or using data in ways that violate the original collection terms.

Beyond the legal risks, these approaches often backfire through poor deliverability, spam complaints, and damage to your sender reputation.

Consent and Transparency

Building compliant B2B marketing contacts starts with clear consent mechanisms and transparent communication about how you’ll use contact information.

This means being upfront about what recipients will receive, how often they’ll hear from you, and how they can opt out if they choose.

For B2B marketing, the consent standards can be somewhat more flexible than consumer marketing, particularly when contacting business email addresses about legitimate business interests.

However, this doesn’t mean anything goes—recipients should still understand why they’re receiving your messages and have control over future communications.

Building Trust from the Start

Compliance isn’t just about avoiding legal trouble; it’s about establishing the foundation for productive business relationships.

When prospects receive your initial outreach, they’re forming impressions not just about your message, but about your company’s professionalism and trustworthiness.

Start with clear sender identification, professional email design, and messaging that demonstrates you understand their business context.

Include easy-to-find contact information and unsubscribe options. Most importantly, deliver on whatever value proposition prompted them to engage with your initial message.

Read More: Top 10 Leading B2B SaaS Companies

Methods to Find QuickBooks and Xero User Contacts

1. Specialized B2B Databases and List Providers

The most straightforward approach to building QuickBooks and Xero user lists involves partnering with established data providers who specialize in technology usage segmentation.

Companies like ZoomInfo, Apollo, and Leadspace maintain databases that include software usage information, allowing you to filter for businesses actively using specific accounting platforms.

When evaluating potential vendors, look for providers who can demonstrate their data collection methods, compliance procedures, and data freshness practices.

Quality providers should be able to explain how they verify software usage information and maintain contact accuracy over time.

The main advantage of this approach is scale and efficiency—you can access thousands of qualified contacts relatively quickly. However, these lists often come at a premium price, and the contacts may not be as warm as those generated through your own marketing efforts. Additionally, you’ll be competing with other companies who have purchased similar lists.

Before committing to a large purchase, test smaller segments to evaluate data quality, deliverability rates, and response levels. Pay particular attention to bounce rates and spam complaints, as these can indicate data quality issues that might damage your sender reputation.

2. LinkedIn Prospecting

LinkedIn Sales Navigator offers sophisticated filtering options that make it particularly effective for finding QuickBooks and Xero users.

You can combine job title filters (CFO, Controller, Bookkeeper) with skills filters (QuickBooks, Xero) and industry filters to create highly targeted prospect lists.

The key to LinkedIn prospecting success lies in the relationship-building approach. Rather than immediately pitching your service, focus on connecting with prospects and engaging with their content to establish familiarity before introducing your solution.

LinkedIn’s advanced search capabilities also allow you to identify companies posting job openings that mention QuickBooks or Xero experience requirements.

These companies are clearly active users of these platforms and may be growing their finance teams, suggesting potential receptivity to tools that improve efficiency.

Once you’ve identified prospects on LinkedIn, you can use email finder tools to locate their business email addresses, though this requires careful attention to compliance and professional etiquette in your outreach.

3. Partnerships and Affiliates

Some of the highest-quality leads come through strategic partnerships with professionals who already serve QuickBooks and Xero users.

Accounting firms, bookkeeping services, business consultants, and even complementary SaaS companies often have established relationships with exactly the audience you want to reach.

These partnerships can take various forms, from formal referral programs to content collaboration arrangements.

For example, you might co-create a webinar about financial efficiency best practices, with your partner providing the accounting expertise while you demonstrate how your solution integrates with their clients’ existing workflows.

The advantage of partnership-generated leads is the implicit endorsement that comes from a trusted advisor’s recommendation. These prospects are often warmer and more receptive because they’re hearing about your solution through someone they already trust.

4. Lead Generation Tools

Modern lead generation tools have become increasingly sophisticated at identifying technology usage signals and providing contact information for decision-makers at companies using specific software platforms.

Hunter.io excels at finding email addresses when you know the company name and can make educated guesses about email formats.

Apollo combines contact discovery with CRM functionality, allowing you to build and nurture prospect lists within a single platform. ZoomInfo provides comprehensive company and contact information, including technology usage data.

These tools work best when you can identify specific companies using QuickBooks or Xero through other methods, then use the tools to find the right contacts within those organizations.

Look for signals like job postings mentioning specific software requirements, technology stack information on company websites, or integration listings on QuickBooks and Xero marketplaces.

5. B2B Communities & Events

Accounting software users often participate in industry-specific communities, both online and offline. QuickBooks and Xero host their own user conferences, webinars, and online forums where active users share best practices and seek solutions to common challenges.

These venues provide opportunities to collect contact information through valuable content offerings. Consider creating detailed guides, templates, or tools that address common pain points for accounting software users, then gate this content behind a simple email signup form.

Industry associations, local business groups, and specialized forums also attract accounting software users.

Participating authentically in these communities—by providing helpful answers, sharing relevant insights, and building genuine relationships – can generate high-quality leads over time.

The key is leading with value rather than sales pitches. Focus on solving problems and demonstrating expertise, and the business development opportunities will follow naturally.

Step-by-Step Guide: Verifying, Segmenting, and Cleaning Emails

1. Verification Tools

Once you’ve collected email addresses through any of the methods above, verification becomes crucial for maintaining sender reputation and maximizing campaign effectiveness.

Tools like ZeroBounce and NeverBounce check email addresses against known bounce patterns, spam traps, and inactive accounts before you send your first message.

Quality verification tools provide several types of validation: syntax checking ensures email addresses follow proper formatting rules, domain validation confirms that the email domain exists and accepts mail, and mailbox verification attempts to confirm that the specific email address is active and accepting messages.

Don’t skip this step, even if you’re working with supposedly high-quality purchased lists. Verification typically costs just a few cents per email address, but it can prevent the much larger costs associated with poor deliverability, spam complaints, and damaged sender reputation.

2. Segmentation by Role

Not all QuickBooks and Xero users have the same needs, decision-making authority, or communication preferences.

A CFO at a 50-person company faces different challenges than a small business owner managing their own books, and your messaging should reflect these differences.

Create segments based on job titles and company size: small business owners (typically under 10 employees), bookkeepers and accountants (who may serve multiple clients), finance managers at growing companies (10-50 employees), and senior finance executives at larger organizations (50+ employees).

Each segment requires different messaging approaches. Small business owners often care most about time savings and simplicity.

Bookkeepers and accountants value efficiency tools that help them serve more clients. Finance managers focus on accuracy and reporting capabilities. Senior executives are interested in strategic insights and integration with other business systems.

3. Data Enrichment

Basic contact information only tells part of the story. Data enrichment services can add valuable context like company revenue, employee count, industry classification, technology stack information, and recent funding or growth indicators.

This additional information enables more sophisticated segmentation and personalization. For example, you might tailor your messaging differently for a rapidly growing startup versus an established company, or adjust your approach based on what other business software the prospect uses.

Enrichment also helps with lead scoring and prioritization. A prospect at a company that’s recently raised funding or posted job openings might be more likely to invest in new solutions than someone at a company showing signs of contraction.

4. Cleaning and Updating Lists

Email lists decay naturally over time as people change jobs, companies evolve, and contact information becomes outdated.

Industry studies suggest that B2B email lists degrade at a rate of about 20-25% annually, meaning that without regular maintenance, a significant portion of your carefully built list becomes useless within a year.

Implement regular list cleaning procedures that remove bounced emails, unsubscribe requests, and contacts that haven’t engaged with your messages over extended periods.

Many email marketing platforms provide engagement-based segmentation tools that help identify inactive subscribers who might benefit from re-engagement campaigns or removal from your active lists.

Consider setting up automated workflows that update contact information when you receive bounce-back notifications or other signals that contact details have changed.

The investment in list maintenance pays dividends in improved deliverability and engagement rates.

Crafting Effective Outreach Campaigns for QuickBooks and Xero Audiences

Personalization at Scale

Generic email blasts don’t work with sophisticated audiences like QuickBooks and Xero users, who can instantly recognize mass-produced messages.

However, true one-to-one personalization doesn’t scale for most businesses. The solution lies in intelligent personalization that combines automation with relevant customization.

Start by referencing their specific accounting platform in your messaging. A subject line like “Streamline your Xero workflows with automated expense tracking” immediately signals relevance and demonstrates that you understand their current setup.

This simple acknowledgment can significantly improve open rates compared to generic alternatives.

Take personalization further by incorporating industry-specific examples, company size considerations, or challenges common to their role.

A message to a restaurant owner using QuickBooks might reference inventory management and tip reporting challenges, while a message to a professional services firm might focus on time tracking and project profitability analysis.

Value-Driven Messaging

Accounting software users are typically results-oriented individuals who appreciate direct, benefit-focused communication. Lead with the specific value your solution provides rather than features or company background.

Instead of saying “Our platform offers advanced reporting capabilities,” try “Reduce your month-end close process from 5 days to 2 with automated reconciliation that syncs directly with your QuickBooks data.”

This approach immediately communicates the time savings and effort reduction that busy finance professionals care about.

Address common pain points that QuickBooks and Xero users experience: manual data entry, reconciliation challenges, limited reporting options, integration headaches, or workflow inefficiencies. Show how your solution specifically addresses these issues within their existing software environment.

Subject Lines and CTAs

Finance professionals receive numerous vendor emails, so your subject lines need to cut through the noise while remaining professional.

Test subject lines that create curiosity (“The QuickBooks integration your CFO doesn’t know about”), promise specific benefits (“Cut your reconciliation time in half”), or reference timely concerns (“New QuickBooks updates: What they mean for your workflows”).

Avoid overly salesy language, excessive punctuation, or misleading claims that might trigger spam filters or erode trust. Subject lines should accurately reflect the message content while compelling enough to encourage opens.

Your calls-to-action should be specific and low-commitment for initial outreach. Instead of “Schedule a demo,” try “See the 3-minute integration walkthrough” or “Download the QuickBooks optimization checklist.”

These softer CTAs can generate higher response rates from prospects who aren’t ready for a sales conversation but are interested in learning more.

Multi-Channel Approach

Email remains the primary channel for B2B outreach, but combining it with other touchpoints can significantly improve campaign effectiveness.

Use LinkedIn to connect with prospects before or after email outreach, allowing you to engage with their content and build familiarity before introducing your solution.

Retargeting ads can reinforce your message for prospects who’ve opened your emails but haven’t responded. These ads can showcase customer testimonials, case studies, or additional value propositions that complement your email messaging.

Consider phone follow-up for highly qualified prospects, but only after establishing initial contact through other channels. A brief call referencing your previous email can be much more effective than cold calling, especially when you can reference their specific accounting software setup and challenges.

Common Mistakes to Avoid

Buying Low-Quality or Non-Compliant Lists

The pressure to quickly scale outreach efforts often leads marketers toward questionable list providers promising thousands of contacts at bargain prices.

These lists typically contain outdated information, incorrect contact details, and email addresses collected without proper consent—a recipe for poor campaign performance and potential legal issues.

Low-quality lists reveal themselves quickly through high bounce rates, spam complaints, and poor engagement metrics.

More importantly, they can damage your sender reputation with email service providers, making it harder for legitimate messages to reach recipients’ inboxes in the future.

The false economy of cheap lists becomes apparent when you factor in the cost of poor deliverability, wasted time on unqualified prospects, and potential reputation damage. Invest in quality data sources that may cost more upfront but provide better long-term results.

Sending Bulk, Generic Emails

Accounting software users are sophisticated professionals who can immediately identify mass-produced emails. Generic messaging that could apply to any business or any accounting platform signals that you haven’t invested time in understanding their specific context or needs.

Spam traps—email addresses specifically designed to catch unsolicited messages—are often seeded into low-quality lists or can be inadvertently created when you scrape or mass-collect email addresses.

Hitting spam traps can severely damage your sender reputation and may result in your messages being blocked by major email providers.

Even legitimate email addresses can become spam traps over time if they’re abandoned and then monitored for unsolicited messages.

This is why list hygiene and engagement-based segmentation are crucial for maintaining clean, responsive contact databases.

Ignoring Unsubscribe Requests or Compliance Rules

Compliance violations aren’t just legal risks—they’re relationship destroyers that can permanently damage your brand reputation.

When someone requests to unsubscribe from your emails, they’re giving you clear feedback about their interests and preferences.

Ignoring these requests or making the unsubscribe process difficult creates negative experiences that prospects may share with others in their professional networks.

Beyond individual unsubscribe requests, failing to comply with broader privacy regulations can result in significant financial penalties and regulatory scrutiny.

More importantly, it signals to prospects that your company doesn’t respect professional boundaries or legal requirements—hardly the impression you want to create when trying to build business relationships.

Poor List Hygiene Equals High Bounce Rates

Email bounce rates above 2% can trigger scrutiny from email service providers and may result in delivery restrictions or account suspensions.

High bounce rates typically indicate poor list quality, inadequate verification procedures, or failure to maintain contact databases over time.

Bounces fall into two categories: soft bounces (temporary delivery issues like full mailboxes) and hard bounces (permanent delivery failures due to invalid addresses or blocked domains).

While occasional soft bounces are normal, consistent hard bounces indicate systematic list quality problems that require immediate attention.

Regular list cleaning, email verification, and engagement-based segmentation can prevent bounce rate problems before they impact your sender reputation.

Monitor these metrics closely and implement corrective measures quickly when you notice concerning trends.

Best Practices and Tools for Scaling Campaigns

Automation Tools

Modern marketing automation platforms like HubSpot, ActiveCampaign, and Outreach.io enable sophisticated campaign orchestration that would be impossible to manage manually.

These tools allow you to create multi-touch sequences that deliver the right message at the right time based on recipient behavior and engagement patterns.

For QuickBooks and Xero audiences, consider automation workflows that segment prospects based on their accounting platform, company size, and engagement level.

A prospect who opens multiple emails but doesn’t respond might enter a nurture sequence focused on educational content, while someone who clicks through to your website might receive more direct sales-focused messages.

Automation also enables personalization at scale by dynamically inserting relevant information into message templates.

You can create single campaign templates that automatically adjust content based on whether the recipient uses QuickBooks or Xero, their job title, company size, or industry.

CRM Integration

Your lead generation efforts only create value when they feed into systematic follow-up and relationship management processes. Integrating your enriched QuickBooks and Xero contact lists with your CRM system ensures that every interaction is tracked, qualified leads are prioritized, and nothing falls through the cracks.

Look for CRM platforms that can automatically score leads based on criteria relevant to accounting software users: company size, growth indicators, technology adoption patterns, and engagement history. This scoring helps sales teams prioritize their time on the most promising opportunities.

Advanced CRM integration can also trigger personalized outreach based on specific behaviors. For example, a prospect who downloads a QuickBooks integration guide might automatically receive a follow-up sequence focused on implementation best practices, while someone who attends a webinar might get invitations to similar educational events.

Performance Tracking

Successful campaign scaling requires continuous measurement and optimization based on meaningful metrics. Beyond basic open and click-through rates, track metrics that indicate genuine business interest: content downloads, demo requests, trial signups, and qualified sales conversations.

Segment your performance analysis by prospect characteristics to identify patterns in what resonates with different audience types.

You might discover that small business owners respond better to ROI-focused messaging, while accountants prefer feature-detailed communications, or that Xero users have different engagement patterns than QuickBooks users.

Pay particular attention to metrics that indicate list quality and sender reputation: bounce rates, spam complaint rates, and unsubscribe patterns. Sudden changes in these metrics can signal deliverability issues that require immediate attention.

Continuous Optimization

B2B marketing to accounting software users requires ongoing testing and refinement as audience preferences evolve and competition intensifies.

Implement systematic A/B testing for subject lines, message content, send times, and call-to-action language.

Test one element at a time to isolate what drives performance improvements. For example, you might test subject lines that emphasize time savings versus cost reduction, or compare messages that focus on QuickBooks integration versus general efficiency benefits.

Document your testing results and apply successful strategies across similar campaigns. What works for QuickBooks users might also resonate with users of other accounting platforms, and successful messaging approaches can often be adapted for different audience segments.

Final Thoughts

QuickBooks and Xero users represent one of the most valuable and accessible audiences in B2B marketing—millions of decision-makers who’ve already demonstrated their willingness to invest in business-improving technology and their commitment to professional financial management practices.

These aren’t casual prospects; they’re sophisticated business operators actively seeking solutions that integrate with their existing workflows and deliver measurable results.

The opportunity is substantial, but success requires a strategic approach that balances aggressive growth objectives with ethical marketing practices and genuine value delivery.

The companies that thrive in reaching these audiences are those that view compliance not as a constraint, but as a foundation for building trust-based relationships that generate long-term customer value.

Remember that every email address represents a real person managing real business challenges. The most effective campaigns are those that demonstrate genuine understanding of these challenges and offer specific, relevant solutions. Whether you’re offering SaaS integrations, professional services, or complementary business tools, your success will depend on your ability to communicate value clearly and respectfully.

Start with one or two of the methods outlined in this guide, focus on building a smaller list of high-quality, compliant contacts rather than chasing large numbers, and invest time in crafting messages that demonstrate real understanding of accounting software users’ daily realities.

As you refine your approach and demonstrate results, you can scale your efforts using the automation and optimization strategies that turn effective campaigns into sustainable growth engines.

The accounting software user audience isn’t going anywhere—QuickBooks and Xero continue to expand their market share as more businesses embrace cloud-based financial management.

The question isn’t whether this audience represents a valuable opportunity, but whether you’ll implement the systematic, compliant, and value-focused approach needed to reach them effectively.